By Emmanuel Orjih

On 5 January, I published an essay titled “Will Nigeria’s Poor Pay Bola’s Tax.” On 8 January, an official rejoinder to that essay was issued from the Presidential Villa, State House, by Tanimu Yakubu, Director General of the Budget Office of the Federation. That response addressed the arithmetic and internal structure of the tax regime. I treated it accordingly. Responded to it directly, at length, and on the merits. Readers interested in the substantive policy questions, the thresholds, the deductions, the internal logic of the framework, should read that exchange. Those issues have been joined, examined, and closed there.

But two official responses were issued. And both were coordinated by The Presidency.

A separate rejoinder on the same subject was published later, under the name and title of Dr Tope Fasua, Special Adviser to the President on Economic Affairs. Circulated as an individual intervention but carrying the weight of his advisory designation, it presents itself as a standalone intellectual contribution. That posture carries obligations.

A basic test of intellectual contribution is whether a subsequent intervention adds original reasoning beyond what has already been stated. On that test, Dr Fasua’s piece does not meet the minimum threshold. In technical content, it restates positions already advanced in the earlier official rejoinder, without independent reconstruction of method, without fresh reasoning, and without any additional analytical labour that would justify a second intervention. Where a standalone intervention reproduces prior official formulations so closely, it does not function as independent analysis and cannot be credited as an original intellectual contribution. No analytical purpose is served by duplicative engagement. And at a lower level of rigour.

For the avoidance of doubt, I do not relitigate resolved issues, and I do not debate non-issues. I have already dealt with the substantive response. I will not duplicate that work here. What remains is a text that must be assessed on its own terms and merits, as writing presented under the authority of high public office.

Accordingly, what follows is an examiner’s assessment. It evaluates the submission on structure, method, precision of language, analytical sufficiency, implementation potential, and general advisory quality, applying standards ordinarily expected of serious advisory work. The findings are set out plainly.

FINDING ONE: Prediction Presented as Settled Fact

Having established that Dr Tope Fasua’s intervention does not function as an independent analytical contribution, one claim within the text is advanced as original. That claim concerns outcomes.

Dr Fasua asserts that the new tax regime has already produced, or will imminently produce, relief for low and middle income earners. He writes that the regime has “kicked in” and that “any honest observer” will see that no group is bearing a larger tax burden. He further asserts that, by the end of January, most lower to middle level staff will see a reduction in their tax liabilities, and that for the majority of low income earners who pay rent and make statutory contributions, tax payable will be zero.

These are outcome claims. They purport to describe effects already realised or about to be realised across large segments of the income distribution. Claims of this type carry a burden. In serious advisory work, they are ordinarily supported by demonstrable material: illustrative payslips, distributional tables, stated income ranges, explicit assumptions, qualifying conditions, or a disclosed method by which the conclusion was reached.

None is provided. No payroll examples appear. No income bands are identified. No assumptions are stated. No conditions are specified under which the claim holds or ceases to hold. No analytical pathway is shown. The conclusion is presented as self-evident and the reader is expected to accept it on authority.

The same deficiency appears in numeric form through the presentation of a precise monthly tax outcome for a low income earner, Joseph. A specific figure is asserted, yet the derivation is absent. Precision is invoked without exposition. In analytical writing, numbers are meaningful only to the extent that their construction is visible. Where the construction is withheld or conjured as a rabbit out of a magicians hat, the figure functions as performative proclamation and rhetorical exhibitionism, rather than analysis. These are requirements ordinarily taught at the entry point of Economics and enforced as prerequisites for any claim to analytical seriousness and empiricism.

What is observable here is a consistent methodological lapse. Projected effects are treated as established results. Assertions are advanced without the scaffolding required to test them. The submission does not supply the information necessary for verification, replication, or falsification, revealing a level of analytical insufficiency so complete that failure is visible without inference and charity becomes analytically irresponsible.

Conclusion

Where an advisory submission advances population wide outcomes as settled fact while withholding method, assumptions, conditions, and evidentiary support, it fails the threshold of analytical sufficiency. Such work cannot be evaluated for correctness because it has not first met the basic standards that make evaluation possible. This is a failure of method and discipline. At that level, the submission does not satisfy basic expectations attached to public economic advisory authority.

FINDING TWO: Incoherent Posture Presented as Advisory Analysis

Dr Tope Fasua writes in a manner that alternates between detachment and claimed authority. He refers to the author as “one Emmanuel Orjih” and states that the author “claims to be an ex World Bank staff,” language that signals distance and uncertainty. In the same submission, he writes, “Orjih should know better,” and later states, “Orjih knows this,” language that assumes professional knowledge, familiarity, and obligation. These positions cannot be sustained together. A submission that questions a subject’s standing while simultaneously imputing expert knowledge and intent operates without a stable analytical frame. The inconsistency extends beyond posture to certainty. Dr Tope Fasua assigns motive and intent using categorical language. He writes that the argument “can only be explained” by an attempt to “scuttle a good idea,” that it “reveals Orjih’s real intent,” and that it reflects “falsehood.” These are personal predictions stated as fact. In other parts of the same text, he relies on predictive claims about what “will” happen and what observers “will see,” without evidentiary grounding. The document moves between accusation, prediction, assertion, and explanation without a consistent analytical register.

Conclusion: Dr Fasua’s rejoinder is 1,578 words. In Economics, a submission of roughly 1,600 words functions as an extended abstract, the smallest unit at which an argument is expected to hold coherently before it is permitted to scale. Where a text cannot sustain a single line of logic across that span, extension does not rescue the reasoning; it merely multiplies the failure. Policy design demands coherence maintained across assumptions, instruments, trade-offs, and time. A submission that fragments at the level of an extended abstract cannot plausibly support the analytical burdens of economic policy.

FINDING THREE: Failure of Language Discipline and Loss of Analytical Credibility

Public analytical interventions rise or fall on precision of language. Dr Tope Fasua writes, “wreaks of deliberate obfuscation.” The correct word in this context is “reeks.” The term used conveys destruction rather than odor and is incorrect as written. He writes, “It wreaks of voyeurism and schadenfreude.” The same error is repeated. The repetition establishes pattern rather than accident. These errors appear in a document circulated nationally under the authority of the Presidency. Language errors of this nature matter because they occur at the level of single words. Single word accuracy is the minimum unit of analytical discipline. A text that fails at this level signals insufficient review, insufficient care, and insufficient internal control. The problem extends beyond spelling to meaning. Terms such as “voyeurism,” “schadenfreude,” “obliterate the money trail,” and “distasteful writer” are deployed without definition, scope, or analytical function. They operate as emotive labels rather than analytical tools. A public analytical intervention that substitutes imprecise language and emotive descriptors for defined terms abandons analytical clarity.

Conclusion. A document that fails basic language discipline cannot be relied upon for precise policy reasoning. Errors visible at the level of words indicate errors at the level of thought. Words and precision matter.

FINDING FOUR: Substitution of Motive Attribution for Analytical Demonstration

Submissions presented as public analysis are evaluated on reasoning, evidence, and method. Dr Tope Fasua repeatedly attributes motive to the author rather than addressing the argument presented. He writes that the essay “tries to dissemble, rabble rouse and confuse Nigerians,” that it represents “deliberate obfuscation,” that the author is an “unrepentant cynic,” and that the intervention seeks to “obliterate the money trail.” These statements assign intent, psychology, and strategy. They do not demonstrate error in logic, error in arithmetic, or error in interpretation of law. Motive attribution functions as a substitute for analytical demonstration. It shifts attention away from verifiable claims and toward character assessment. This technique does not resolve policy questions. It avoids them. The reliance on motive also produces internal inflation. Assertions escalate without accompanying proof. Language intensifies while analytical content remains static. A public analytical intervention that centers motive rather than method forfeits analytical authority.

Conclusion. When motive is substituted for method, analysis is displaced by accusation. A submission that relies on imputing intent rather than demonstrating error abandons the tools by which public reasoning is evaluated and corrected. As language escalates while evidence remains absent, the work ceases to contribute to policy understanding and instead performs judgment without proof. At that point, analytical authority is not merely weakened; it is surrendered, and the intervention removes itself, by itself, from the domain of serious public analysis.

FINDING FIVE: Omission of Enforcement Realities and Safeguards for the Poor

Public analytical interventions concerning taxation are incomplete without addressing enforcement. Dr Tope Fasua asserts outcomes while omitting operational detail. He writes that relief “will” occur, that liabilities “will” fall to zero for many earners, and that observers “will see” reductions. The text contains no discussion of enforcement practice, grievance handling, dispute resolution, administrative discretion, or error correction. No reference is made to assessment processes. No reference is made to audit triggers. No reference is made to appeals pathways. No reference is made to timelines for correction. No reference is made to remedies available to informal earners subjected to incorrect deductions or coercive collection. The omission is material. Tax outcomes are not produced by statutory text alone. They are produced by implementation, interpretation, and enforcement behavior across thousands of interactions. A submission that addresses outcomes without addressing enforcement omits the mechanism that determines lived impact. This omission bears directly on the poor. Enforcement discretion concentrates risk downward. Informal earners face limited recourse. Administrative error compounds quickly at low income levels.

Conclusion. An analysis that asserts outcomes while erasing enforcement erases the poor themselves. In a country where poverty is the overwhelming condition rather than the margin, such omission is not technical oversight but analytical blindness. Policy that cannot see the poor cannot govern them, and analysis that cannot see them cannot claim to evaluate policy at all. In a country that is statistically Earth’s Poverty Factory where poor people are mass produced in unmatched scale, when power loses sight of the poor as evidenced by the submission of the President’s Special Adviser on Economic Affairs, economic outcomes tend towards the extreme and the negative.

SUMMARY AND CONCLUSION

This examination is now complete.

The text examined presents itself as serious public analysis. The findings show otherwise.

The intervention repeats official language already on record. It offers no independent reasoning. It promises outcomes without showing how they are reached. It shifts position within the same argument. It uses careless language in a national document. It assigns motives where proof is required. It ignores how policy is enforced on the ground.

Reasoning that fails at this level fails in practice. When such reasoning informs governance, error becomes policy and confusion becomes harm.

The poor bear that harm first.

This is how intellectual failure becomes national consequence.

This record now stands on its own.

Yours in Service.

Emmanuel Orjih

The Steward, Stop This Tax

StopThisTax.org | emmanuel@stopthistax.org

Addendum: A Diagnostic Question

The preceding examination treated one public intervention as a specimen. The question that now follows is whether that specimen, Dr Tope Fasua, reveals something larger.

A. If a senior public intervention, in charge of providing special advisory to a President on “Economic Affairs” cannot sustain a single line of reasoning from beginning to end, is that an individual limitation or a system signal?

B. If an argument fragments, reverses posture, asserts outcomes without method, and omits enforcement realities, is that an isolated lapse or a window into how decisions are formed?

C. If reasoning collapses on a narrow and contained subject, what happens when the subject is complex, sequential, and high risk?

D. Could this be one reason why a single tax law could not be produced cleanly (even if impropriety was officially intended), but instead circulated in multiple versions, debated publicly, revised repeatedly, and defended inconsistently?

E. Is this why policy announcements are issued, withdrawn, reissued, and reinterpreted within days?

F. Is this why appointments are announced and reversed, pardons granted and rescinded, positions filled and later disowned?

G. Is this why execution stalls even when intent is declared, because intent cannot be carried through a full sequence of decisions?

H. If a system cannot hold one thought long enough to complete it, can it deliver ten steps without failure?

I. If reasoning fragments at the advisory level, does execution fragment at the operational level?

J. When execution fragments, who absorbs the cost?

K. Who bears enforcement error?

L. Who bears delay?

M. Who bears discretion?

N. Who bears cost of reversal?

O. Is it the powerful, who can shield themselves, negotiate exceptions, and wait out confusion?

P. Or is it the poor, who face immediate enforcement, limited recourse, and no buffer against mistake?

Q. Have the poor not already been paying an implicit tax for years through fuel mismanagement, infrastructure failure, private substitution for public services, high transport costs, high food prices, and collapsed health and education systems?

R. When oil revenues were mismanaged, who paid?

S. When roads failed, who paid?

T. When hospitals collapsed, who paid?

U. When schools decayed, who paid?

V. If those costs were pushed downward then, why would the formalisation of taxation behave differently now?

W. Is the current tax debate not occurring because the system failed to manage what it already had?

X. If so, is the poor population now being asked to fund accumulated failure?

Y. Even if the poor will fund it, are they not fully entitled to insist that such must not occur again? To insist that EVERY SINGLE NAIRA COLLECTED FROM THEM IN THE GUISE OF TAX MUST BE HANDLED WITH 100% TRANSPARENCY AND ACCOUNTABILILTY?

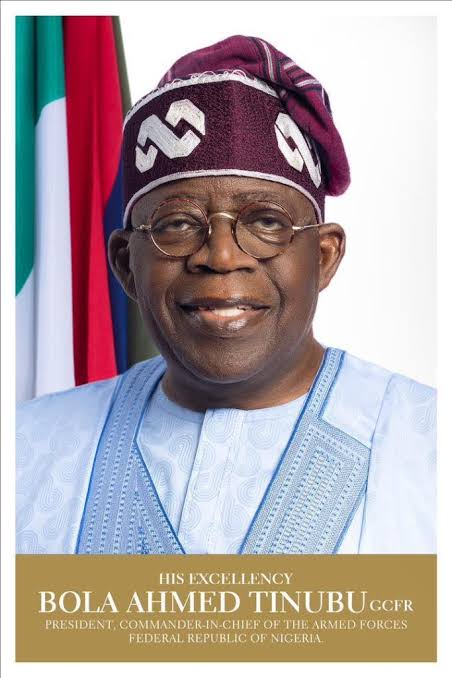

Z. Is Dr. Tope Fasua’s clear intellectual and advisory shortcomings in the Economic sphere, a specimen through which we may very accurately view and understand the systemic failings and shortcomings of President Bola Ahmed Tinubu’s government, especially in its economic duty to 143 million poor Nigerians?

These are not abstract questions.

They point forward.

Part Three will examine whether this pattern repeats across governance outputs, and whether what appears as individual failure is in fact institutional design.

CONCLUDED.

For more, visit: StopThisTax.org